CFA Exam Level 3 2012… after thoughts

Last year, I promised to write a summary of Readings while preparing for Level 3, I barely had enough time to go over the material once…

My preparation was at best 3 weeks of total studying time:

- Schweser notes and videos

- CFA mock exam

- 2 Schweser exams which were much more difficult than the mock exam

Exam

I think the exam was fair – I can’t say that it was too easy or difficult, well balanced I think.

For me the morning session was easier than afternoon, perhaps because of the different exam format is ‘feels’ easier…

- With short essays, you write what you think is the best and the correct answer… but because of the subjective nature of answers, you are not sure if your answer is correct… however, I think it does increase your confidence…

I thought the afternoon session was difficult mostly because I wasn’t well prepared…

- I didn’t expect some material to show up but it did… (especially in Ethics & AI)

- I don’t think there were many tricky questions (like for Level 2 2011)

- I don’t know what was new material vs 2011 so not sure if the new material was covered

I don’t think my preparation approach was right besides the obvious insufficient time, I don’t recollect reading some of the exam questions in Schweser notes or videos.

I give my self a slightly more than 50% chance of passing…

What did you think?

Nitrogen pure play stocks – TNH, UAN, RNF

I have been watching these 3 pure play nitrogen fertilizer stocks…

Terra Nitrogen Co. LP (TNH), CVR Partners (UAN), Rentech Nitrogen Partners (RNF)…

All three had a very good run since the beginning of the year to until about Monday, 9 Jan 2012… gaining anywhere from 11-22% in 5 days… however, they have fallen sharply in the past couple days…

in my opinion, the up trend is likely to continue…

TNH – $166-170 entry point

UAN – I am inclined to wait for a little bit even though the recent drop has retraced the 50% fibonacci levels… I think good entry points in the $25 area..

RNF – this is a new issue and hasn’t traded long enough to deduce anything meaningful… although based on the recent run-up, I want to wait till it drops to the 50% fibonacci level around $18

Silver heading to 25

I’m using SLV as a proxy for Silver… SLV is down huge on above average volume when the overall trading volume is fairly low…

· 50% Fibonacci retracement for the run from early 2009 to the May 2011 peak is around $25

· 25 is a nice round number to anchor psychologically

· next major support is also at 25

Link fest – Will the ECB backdoor bailout work?

How big could the Sarko trade go? (FT Alphaville)

It is finally being recognized that the eurozone made a major policy breakthrough (Marginal Revolution)

ECB backdoor bailout? (Business Insider, Modeled Behaviour)

Why ECB lending won’t solve the euro crisis (Felix Salmon)

Banks resist European pressure to buy government debt (IFRE)

sitting out, staying put and clarity of thought

I have been meaning to write this post for the last few days… and have finally found the time.

At the beginning of stock market decline in Aug, I was about 7% stocks, 8% bonds and 85% cash… today I’m about 17% stocks, 8% bonds & 75% cash…

A lot of the blogs/comments I have read over the past two years and particularly during the stock market decline in Aug/Sep made me really realize the virtue and reward of staying out and staying put…

Knowing when to sit out and watch the market from the side lines is just as important as finding good trade setups and investment ideas… if you don’t find any, be patient, read/study, analyze and pound when the time is right… I have this much from many bloggers particularly the folks on Stocktwits.

Sitting out has tremendous benefits:

- I didn’t not feel the need to look at my portfolio 3 times a day even after the market dropped 10% and was dropping more… more time to do things I want to do

- I was able to consume and more importantly comprehend whatever I read, be it MSM or the very informative, educational and mostly unbiased financial/econo-blogosphere – it is natural to comprehend less when you are worried.

- I had all the time in the world to read about topics I was interested in rather than looking for topics/posts that would make me feel better and confirm my supposed rationale for holding stocks

- I could analyze a trade or an investment idea with fewer inherent biases

Sitting out is one of the hardest things to do possibly because of the fear of missing out… overcome the fear of missing out and you will have a clearer mind to analyze more opportunities ahead.

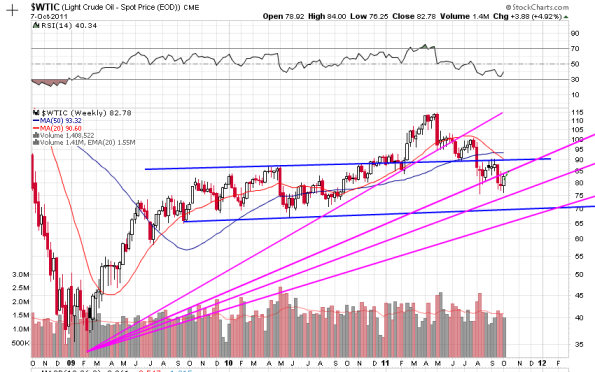

Range bound markets in WTI?

TSX trading near 2-year low… 11000 next downside target?

Funding sources for banks – Wholesale Funding… writing so I can remember (hopefully)

In the previous post I wrote about the ‘primary’ source of funding for Banks i.e. Demand Deposits… In this post I will enumerate on Wholesale Funding sources. The level of detail might be random because my goal is to get a basic understanding and then try to look at the Euro crisis from this understanding… and also refer to it later. There are many blogs and sites that have done a fantastic job of explaining the details and the mechanics.

Wholesale Funding

There are many types of Wholesale Funding sources available to a commercial bank:

– Interbank Market at or near the Central Bank’s overnight target rate

– REPO (Repurchase Agreement) – “…is the sale of securities together with an agreement for the seller to buy back the securities at a later date. The repurchase price should be greater than the original sale price, the difference effectively representing interest, sometimes called the repo rate…”

– Central Bank – various programs and facilities since the 2008 financial crisis

– Central Bank Discount Window at the Discount Rate

The Central bank becomes the clichéd ‘lender of last resort’ when wholesale funding disappears.

Typical characteristics of wholesale funding:

– usually very sensitive to interest rate fluctuations and hence more expensive

– Less stable than demand deposits. The risk of wholesale funding is that can disappear anytime as is happening for some of the European banks and is also what exacerbated the 2008 financial crisis.

Q – What does a bank’s balance sheet look like when any of the wholesale funding sources are present?

– The economic effect of wholesale funding is identical to the bank receiving a loan from another financial institution. As far as the balance sheet goes, a matching asset and liability are created which expands the bank’s balance sheet.

Raise Capital

There is one more avenue a commercial bank can pursue and that is to raise capital by issuing Bonds, Debentures, Preferred shares, Common Shares, etc. Typically raising capital is the last resort and/or is reserved for long term investments or long term projects (e.g. new building)

Q – What happens to a bank’s balance sheet when a bank raises capital by issuing bonds or stock?

Let’s say, the Bank (from previous post) raises capital by issuing $100 of equity, the balance sheet looks like

A = Loan + Reserves + Cash = 90 + 10 + 100 = 200

L+E = Deposit + Equity = 100 + 100 = 200

(assume, $100 deposit, $90 loan and $10 reserves)

Q – Now, what can the bank do with the $100 capital? Can the bank lend it to a borrower?

– Yes

Q – Does the bank have to maintain a reserve on the full $200 or only on the $100?

– The bank needs to maintain reserves against the deposits so only on $100.

Q – Why and how does a bank hold government securities?

– The bank lends money to the government by buying government issued securities – this shows as an asset on the banks BS

Funding sources for banks – Demand Deposits… writing so I can remember (hopefully)

Yesterday morning, I was reading a post on FTAV about Greek depositors fleeing Greek banks and with the Fed’s announcement of Operation Twist, I realized that I need to refresh my understanding of “how banks work”… and particularly the funding sources of a bank and eventually the role of central bank…

There are two primary source of bank funding:

– Demand Deposits (cheapest source of funding)

– Wholesale Funding – from other banks and providers of capital

In this post my goal is to get a basic understanding of Demand Deposits:

Q – How does a bank fund itself by using demand deposits? What does a bank’s balance sheet look like when I deposit $100?

In a fractional reserve banking system, a demand deposit is a bank’s liability to the depositor… the depositor can withdraw for his/her deposit at anytime. A bank can then loan out a portion of the deposit to a credible borrower (companies, persons, other banks, etc)… the portion of the deposit that is not lent is considered reserves… reserves appear as an asset on a bank’s balance sheet…

At Initiation, t = 0

Asset = Loan + Reserves = 90 + 10

Liability +Equity = Deposit = 100

In future, t = 1

Scenario A – Bank makes profit on the loan

The bank makes money by making a profit on the loan (assume bank does not have to pay interest to the depositor), let’s say the bank makes 5% on the loaned amount.

A = Loan + Reserves + Cash = 90 + 10 +5 = 105

L + E = Deposit + Profit (Retained Earning) = 100 + 5 = 105

Scenario B – Bank makes a loss on the loan

The bank loses $5 on the loan because the borrower will not be able to payback.

A = Loan + Reserves + Cash = 85 + 10 = 95

L + E = Deposit + Loss (Retained Earning) = 100 = 95

In this scenario, if the depositor demands his money, he must be paid $100 or the bank must go bankrupt. The bank has only $95 in assets…where and how does the bank get the ‘extra’ $5?

– The bank can fund the $5 in one or more of following ways:

– get more deposits

– borrow short-term money from other banks

– borrow from central

– raise capital in the open market (bonds, stocks, etc)

– Or the bank declares bankruptcy

– If this scenario happened after Scenario A, then the bank would have just enough ($5 profit cancels the $5 loss) to cover the deposit

Note that reserves only apply to demand deposits… The reserves ratio requirements imposed by some central banks create a ceiling on the amount that can be lent given a deposit amount… but if a bank has more credible borrowers than can be met by the level of its deposits, then the bank can fund these loans by raising capital or with wholesale funding…

Next post will be about wholesale funding…

Return

End of summer, start of autumn, return from hiatus… Actually, after CFA L2, I was super busy at work with an overseas project and I also moved homes so didn’t get any time to blog… I recently read this post which has inspired and motivated me to restart/resume/continue blogging… particularly this comparison:

Writing Is Like Working Out: Like working out, writing gets more and more difficult each day you skip. And if you skip a week or more, the mob euphemism “ForgetAboutIt” becomes quite literal. First you forget about your ideas, then you forget how to string them together into any coherent or entertaining thread, then you just say ‘forget it’ and saddle up on the couch for some despondent channel surfing. You stare at your Twitter or Facebook streams waiting for something to inspire you, and when it does, you might re-Tweet or Like it, or maybe you just let it pass as you search for something even more inspiring. Then the nights and weeks have passed and you haven’t even tried to get back into the swing.