Archive

Detailed Analysis of GTA Housing Market – up to August 2010

I have been posting housing stats for a couple months now but I never thought about seasonality… housing moves in cycles – like a lot of other markets – due to two major factors: weather and school.

The seasonal trend is very clear from this sales chart – sales increase from January to May, then slowly decrease from June to August, pick-up marginally in September and then decline gradually with a sharp drop-off in December

The next logical question is how does seasonality affect prices?

To look at the seasonal trend, I have charted the month-over-month change in resale home prices since 2005.

Even though most market pundits and MSM claim 2009 to be an anomaly, I think the 2009 monthly price trend sticks well to the seasonality.

Here is a line chart with the same data as above (take your pick 😉

(Note: Legend is same in all charts)

This table summarizes the above chart and shows the direction of price movement in a given month:

| Period | Price Direction |

| November-January, Jun-Aug | Decreasing |

| Feb-May, Sep-Oct | Increasing |

So how does this fit into the current numbers ?

Well, GTA prices declined about 8% from Jun-Aug… believe it or not GTA prices declined between 5-8% from 2006-2008, only in 2009 they declined by 2%… so the current trend should not be alarming. Similarly, the decline in Sales is almost in line with previous sales decline of 25-30%.

Is this good news?

To answer this, lets look at the year-over-year changes

Again, line chart with the same data as above year-over-year column chart

(Note: Legend is same in all charts)

The yearly downtrend is against the seasonal uptrend… so the next couple months/quarters should be key.

Low mortgage rates might again drive demand!

Even though prime rate has risen by 75bp or 0.75%, variable mortgage rates have not increased proportionally due to heavier discounting by mortgage brokers/banks.

Before Bank of Canada increased rates, the lowest Variable Rate was around 1.75%. Today, even after a 0.75% increase in rates, the variable mortgage rate is 2.10% – a mere 0.35% increase… so rates haven’t increased as dramatically as the media makes it sound!

Fixed Rates have been dropping in absolute in term due to the recent rally in bond markets… today you can get a 5-year fixed rate mortgage for 3.59%… which is very close to the lowest mortgage rates in 2009!

Mortgage Rates – Fixed or Variable? Redux…

There are plenty of debates on which mortgage rate is better/cheaper to the customer… fixed or variable? Historically variable rates have been lower than fixed rates… agree but just by looking at the two rates at a point in time doesn’t prove that Variable Rate is cheaper than Fixed…

I have seen just one chart comparing the 5-year discounted Fixed Rate to the then Prime Rate (which is a proxy for Variable Rate)… This only shows that variable rate is generally lower than fixed rate at a given point in time… Most brokers forget that variable rates change throughout the term as Bank of Canada changes the bank rate…

To really prove that Variable rate is better than fixed…mostly… i took data from 1973 and calculated the Realized mortgage rate (average rate) on a Variable Rate mortgage over the 5-year term and compared it to the 5-year Fixed rate at the beginning of the mortgage term… The realized variable rate can be thought of as the average or equivalent fixed rate over the 5-year period…

And here are the results… there have been 4 instances in the past 38 years when the variable rate is cheaper than fixed rate at mortgage initation but ends up costing more than fixed rate over the full 5-year term!!

what are your thoughts?

Fixed Mortgage Rates – History since 1980s

Mainstream media & real-estate agents in Canada (& US alike) have been pushing the idea of all-time low mortgage rates to pump the real-estate market. Are mortgage rates really that low? The chart below does prove that the posted 5-Year Fixed Rate Mortgage (orange line) is indeed at historic lows since 1980s.

Is 1980s considered historic lows? May be… the Bank of Canada Interest rate from 1955 to 1980 averaged about 7% and from 1935 to 1955 about 2% which is higher than the 2009 average of 0.75%… I know this rate is more applicable to variable rate mortgages but nevertheless it helps to analyze the possible situation back then.

A Fixed Rate mortgage is one where the interest rate does not change for the term (not amortization) of the mortgage i.e. the interest rate if fixed for the term.

On the other a variable rate mortgage is one where the interest rate on the mortgage or the mortgage rate changes whenever the reference or the benchmark rate changes. In Canada the reference rate is always the Prime Rate; in US it is either the Prime Rate or the LIBOR.

Historical Relationship – Bank of Canada Bank Rate vs Prime Rate

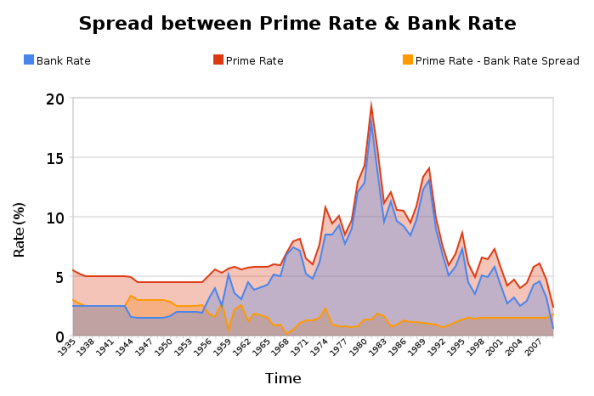

Yesterday I posted a 10-year chart showing the difference between the Bank Rate which is set by Bank of Canada and the Prime Rate which is set by the chartered banks and is the rate the banks will lend to their most creditworthy customers.

Today I bring to you the same chart but going back since 1935… that’s right, the relationship between Bank Rate & Prime rate since 1935!

The spread is clearly at historic lows compared to the earlier half of 20th century but relatively high compared to the latter half

Are Canadian banks gouging consumers & businesses?

For the last decade, the spread between Bank Rate (top end of the Bank of Canada operating band) and the Prime Rate (the rate banks charge their best customers and the rate used as benchmark for almost all loans except fixed rate mortgage) has been about 150 basis points (bp) or 1.5% but since Dec 2008, the spread has increased to 175 bp or 1.75% – see chart below. Prime Rate affects almost all business loans, line of credit (personal, secured, HELOC, etc) and variable rate mortgages.

What determines this spread and why is it still at decade highs when the Big Five Canadian banks have hit record profits in Q1/Q2 2010?