Is Canadian Housing the Next Domino?

Canada’s Housing Market received plenty of international attention last week from the revered The Economist and Australia’s Business Spectator… with that kind of attention, is it time to short Canadian real-estate?

Similarities between Canada & Australia:

- net commodity exporters

- have similar net immigration rates

- largely avoided the 2008-2010 financial crisis

- have highly rated banking systems

- housing market in a potential bubble or is it sound fundamentals

From Business Spectator [emphasis mine]:

…

Canadian home values have risen strongly relative to incomes and rents over the past ten years on the back of sharply rising debt levels. The key charts pertaining to the Canadian housing market are below, taken from Capital Economics’ recent Canadian housing and economic updates.

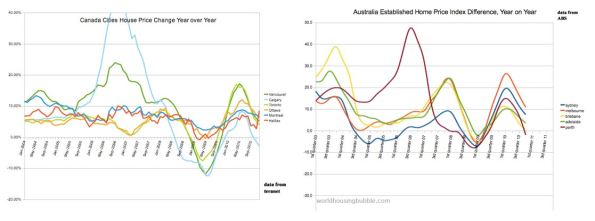

The house price growth of Canada’s major cities compared to Australia’s capital cities is shown below (chart courtesy of World Housing Bubble, here and here).

As you can see, there are some striking similarities between the two countries’ housing markets. First, the two mineral rich cities of Perth and Calgary experienced their own unique house price booms during the 2006/07 commodities bubble. Second, both countries’ governments and central banks were highly successful in reflating their respective housing markets after brief falls during the onset of the global recession.

In Australia’s case, the housing market was reflated by a combination of significantly reduced interest rates, the temporary increase in the first home owners’ grant, cash handouts to households, and the temporary relaxation of foreign ownership rules.

Canada’s central bank and government also provided significant stimulus to the housing market. In addition to the Bank of Canada lowering interest rates to record lows (click to view chart), the government significantly loosened mortgage eligibility criteria, culminating in the introduction of the zero-deposit, 40-year mortgage in 2007. Further, the amount that Canadians could borrow was increased, with many individuals in 2009 being granted loans in the $C500,000 to $C800,000 range, provided their household income ranged from $C110,000 to $C170,000.

One of the many reasons cited for the US housing bubble was low interest rates for a long period, during Alan Greenspan’s era, circa 2005… In Canada, interest rates were at their lowest ever (BOC overnight target rate of 0.25%) from April 2009 to June 2010…During this period, house prices rose about 20%… and presumably a greater than normal share of new mortgages were variable rate mortgages…

Not only was the monetary incentive high but the government loosened the qualifying standards…

Finally, in an effort to support the housing market in 2008 (when affordability fell sharply and the economy stalled), the Canadian government directed the Canadian Mortgage and Housing Corporation – the government-owned guarantor of high loan-to-value-ratio mortgages (explained here) – to approve as many high-risk borrowers as possible in order to keep credit flowing. As a result, the approval rate for these risky loans went from 33 per cent in 2007 to 42 per cent in 2008. By mid-2007, the average Canadian home buyer who took out a mortgage had only 6 per cent equity in their home, suggesting the risk of negative equity is high even if there is only a moderate correction.

This is the key….if the government did not step-in to stimulate the housing market during the throes of the recession, either Canada would have had the necessary downward adjustment to house prices, due to the negative feedback loop and possibly throw the economy in to deflation or was the government’s decision to stimulate and incentivize Canadians to buy real-estate now and worry about potential accelerated house price inflation later? Was the government in a Catch 22?

The Canadian government has since raised the mortgage eligibility criteria. In October 2008, it discontinued the zero down, 40-year mortgage, reverting back to the 5 per cent down, 35-year mortgage requirement that was in place prior to the global recession. Then, last month, the Canadian government announced that it would reduce the maximum amortisation period for mortgages to 30 years from March, adding around $100 in extra loan repayments to the average mortgage. The government also reduced the maximum amount that Canadians could borrow against the value of their homes – called a Home Equity Line of Credit (HELOC) – from 90 per cent to 85 per cent.

Perhaps, the government was in a Catch 22… and that is why it intervened to tighten mortgage rules twice in less than 1 year… The big question is: Are these changes enough or is it too little too late to control the animal spirits? And will Canadian real-estate slow down after March 18?

…Capital Economics released its Canada Economic Outlook Report (Q1 2010), which predicts sharp falls in Canadian house prices, household deleveraging, and anaemic economic growth into the future.

The report warns that Canadians’ belief that their economy is somehow invincible after emerging from the crisis relatively unscathed is “disconcerting” as house prices lose touch with fundamentals.

This is certainly true at the ground level… how much can be attributed to wealth effect from house prices increases?

“Relative to incomes, our calculations suggest that Canadian housing is now just under 40 per cent over-valued, which is about the same level of excess that the US market reached before it collapsed. We have pencilled in a 25 per cent cumulative decline in house prices over three years, mirroring what happened south of the border.

“The biggest downside risk is that an adverse feedback loop could develop, as it did in the US, with rapidly falling house prices leading to a contraction in both output and employment, which puts even more downward pressure on house prices.”

Capital Economics also warns that the government-owned CMHC could be exposed to significant losses should house prices fall significantly.

“According to our reading of CMHC financial statements, insured mortgages and securitised mortgage guarantees total an amount close to $C800 billion. The total equity of CMHC is $C10 billion.

“If house prices collapse further than we predict, say by 35 per cent, with a default rate of 10 per cent and average home equity of 10 per cent, then the potential capital loss amounts to $C20 billion.

“Even if we assume that half of this amount is eventually recovered, that still leaves an expected loss of around $C10 billion. Under the same assumptions, the 25 per cent decline in house prices that we expect over the next few years would still result in a considerable loss of around $C6 billion.”

Only a year ago, the mainstream view in Canada was that the housing market was bullet-proof and that a US-style meltdown was highly improbable. Now sentiment appears to have changed following a collapse of sales, a build-up of inventory, and three consecutive months of price falls between September and November (December recorded a 0.3 per cent rise).

…

Have we Canadians taken comfort in the wide-spread belief that because Canada avoided the global recession that started in the US housing sector , Canadian housing cannot slowdown or experience a US/UK/Ireland like crash?

Bring on the crash!